To be honest I’m surprised that I’ve not had more of these sort of mailings over the last few months as it’s the sort of thing that is a staple part of investment managers’ communication, looking to persuade potential clients that they somehow have insights that nobody else does.

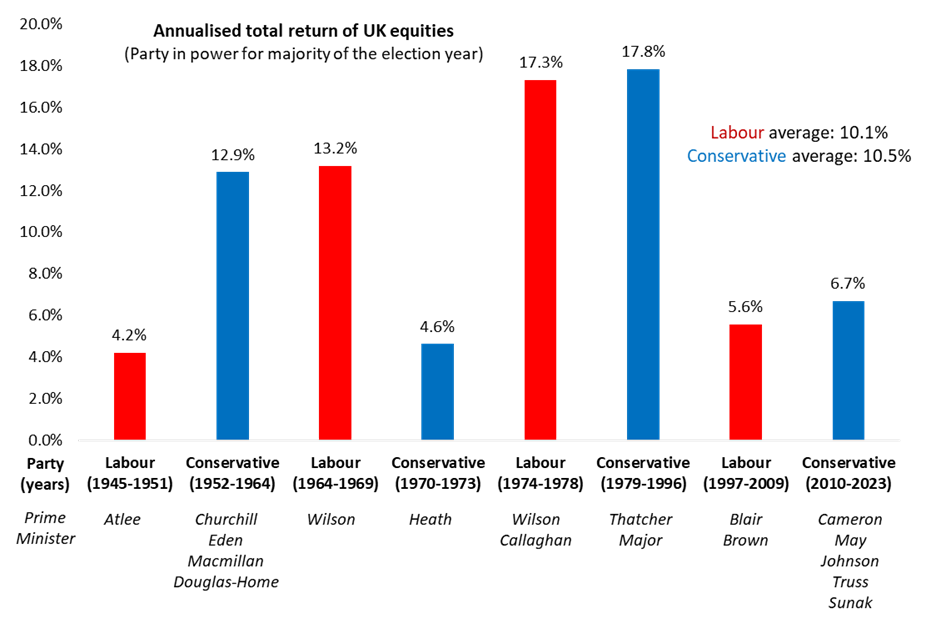

What I did appreciate, as an alternative approach, was a recent mailing that looked at the returns on UK equities for each of the periods that the two main parties have been in Government; and the conclusion that it reached was that the results were pretty much the same.

Furthermore, it asserted that the results would have been pretty much the same whichever party was in power – would Churchill have been any less at the mercy of global factors during the dot-com bust or would Blair have benefited any less from the post-war boom of the 50’s?

Interesting stuff.

We are often reminded that correlation is not necessarily causation and it does make you wonder whether, in terms of investment returns, to what extent government policies can have a direct impact. That’s not to say that they can’t, as we saw during the 49 days of Liz Truss. However, given the similarities in returns, both overall and in consecutive periods of different governments, it suggests that maybe worrying about who is in power (short of say a Marxist-Leninist coup), and what that might mean for “markets”, may not be as important as the active management industry may claim.

I appreciate that it’s a bit boring to say “decide on a mix that’s right for you, diversify, buy the market cheaply and then expect to get what the markets gives you” compared to “we believe the Yen is undervalued and with Saturn in ascendancy and the entrails very red, we recommend increasing your allocation to the US”. However, if focusing on the things that you can control and conceding that nobody knows what the future will bring makes Jack a dull boy, then colour me beige because it makes sense to me.