Although we’ve had very few questions or comments following the turmoil in stockmarkets generated by Donald Trump’s economic decisions, I thought it was worth revisiting a few things that we believe remain true about investments and investment markets (tempting, given the source of the current turmoil to go for “truths that we hold to be self-evident”).

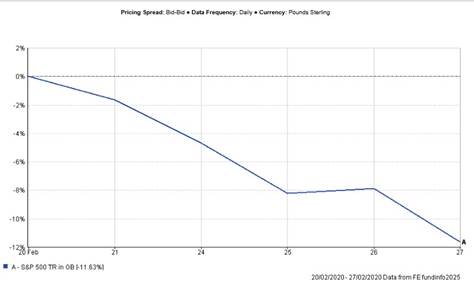

As stockmarkets have dropped sharply today, the first point that we believe is worth reiterating is that this isn’t new, it is simply the latest reaction to a major event that causes uncertainty. The last (ignoring Liz Truss, something that’s surprisingly easy to do) was when Covid swept the world and, sticking with our Star Spangled theme, the impact on the US stockmarket in February 2020 was pronounced

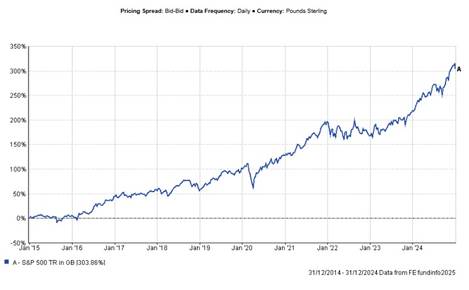

However, we came through the pandemic and lockdowns, and when you pan out and look at the longer term impact on that same stockmarket, it didn’t really make an impact

Where things go next, how long the current turmoil will last and how we come out of it is a complete unknown. Things may well get worse before they get better, especially given that we are possibly just at the start of whatever tariff war may or may not be going on. Nobody knows, unless the rumours of Presidential market manipulation are true of course.

It is worth remembering that stockmarkets, although often spoken about as if they were living things, are simply indices representing the notional value of a group of companies. As such, what they also represent is the sentiment of the people that invest in those companies, and the sentiment of the huge investment industry that exists to both service and benefit from those people.

The stockmarket doesn’t think, doesn’t react, doesn’t price in anything – all of that is done by people. People as we know are flawed, have their own agendas, like to believe that they can pick the next big thing, can act very much like sheep, panic, have selective memories and when everything else fails, will look for someone to believe in when they tell them that they have the answer.

So as quickly as a stockmarket can fall, it can rise and vice versa and nobody knows when or why that will happen. This is why we only ever guarantee that at some point an investment will be worth less than it was the last time that you looked at it. It is also why we always ask if a client would be comfortable if the first thing that their investment did was fall, because if you are not comfortable with both of those ideas then you probably aren’t comfortable investing.

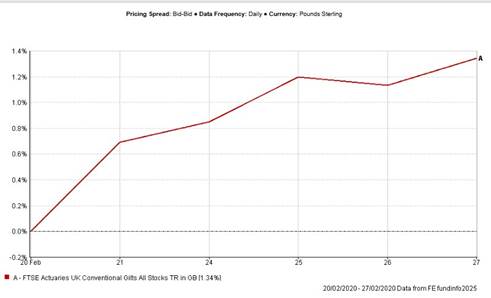

One of the other things that we believe strongly in is that diversification is inherently a good thing. Probably the polar opposite to shares are Government Bonds, Gilts in the UK. Although Gilts themselves have had times of turmoil (hello Liz), in February 2020 they would have done their job

Indeed, as stockmarkets have fallen, so fixed interest indices have risen slightly. Nowhere near enough to offset the stockmarket falls, but when 60% of your portfolio drops by 10%, if 40% goes up by 1% then overall your loss is c5.6% rather than 10%. The same obviously works in the opposite direction when markets soar however, as humans we feel losses far more than we celebrate gains and so the benefits of having that diversification, of smoothing out those troughs, help to make the investment experience a positive one.

So our advice at this stage would be :

The value of investments and any income from them can fall as well as rise. You may not get back the full amount invested. Past performance is used as a guide only; it is no guarantee of future performance.